Junior Bitcoin (JBTC): the proof of holding Asset Token System

JBTC is a fixed-supply, decentralized BEP-20 token on Binance Smart Chain implementing a Proof-of-Holding (PoH) distribution mechanism. Rewards are distributed proportionally to self-custodied holdings via immutable smart contract logic designed for long-term, predictable emissions with energy-efficient, trustless enforcement.

Abstract

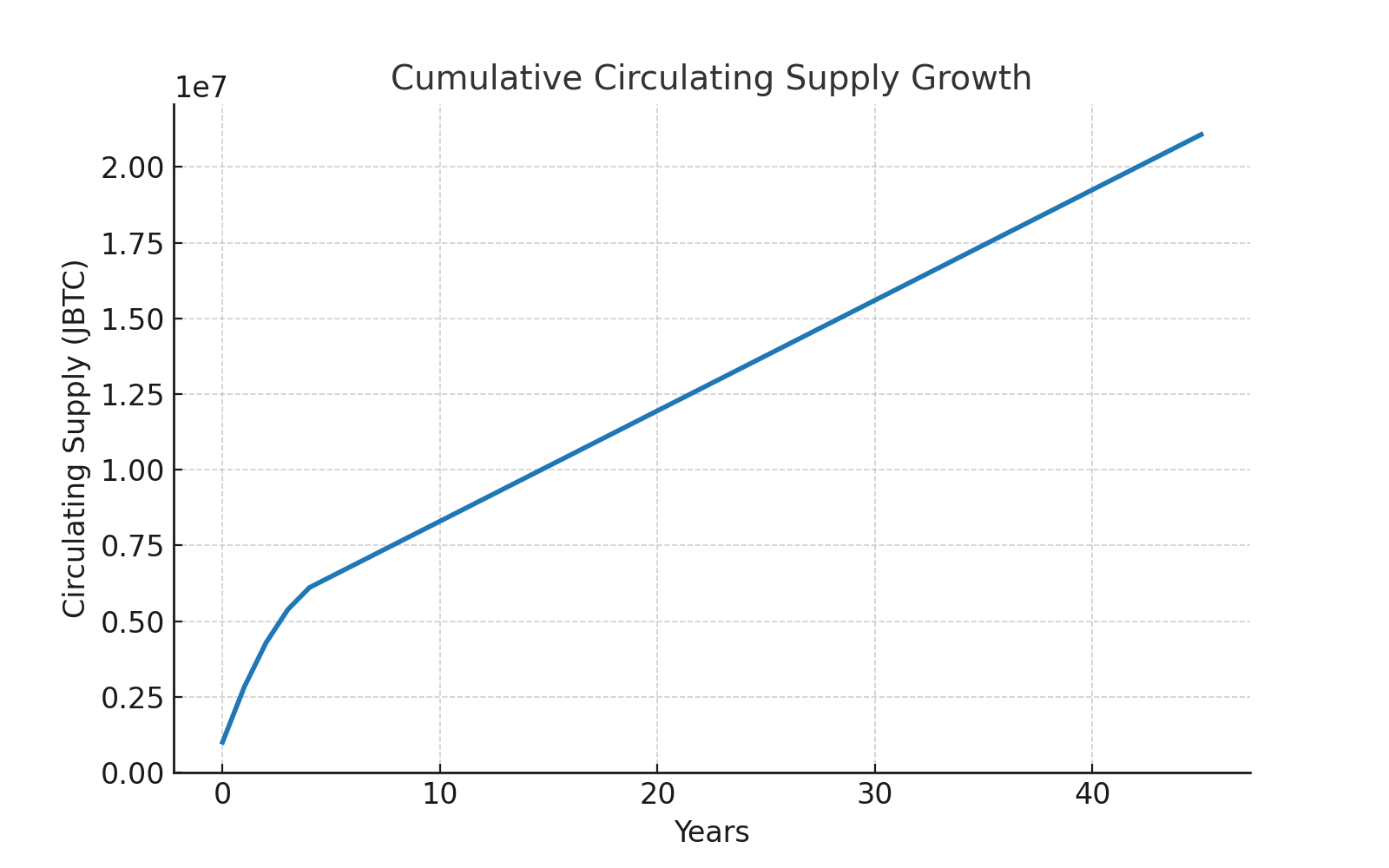

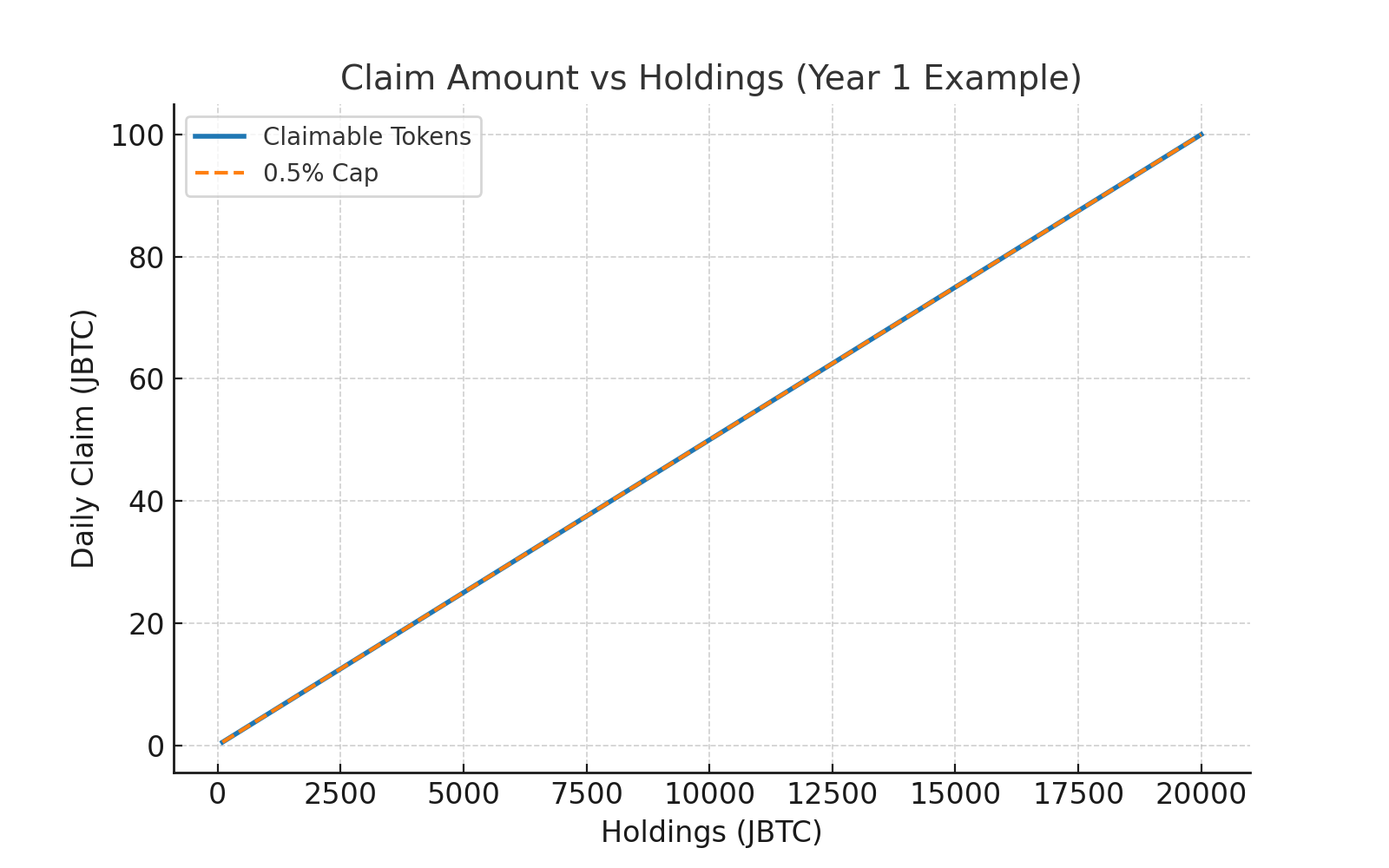

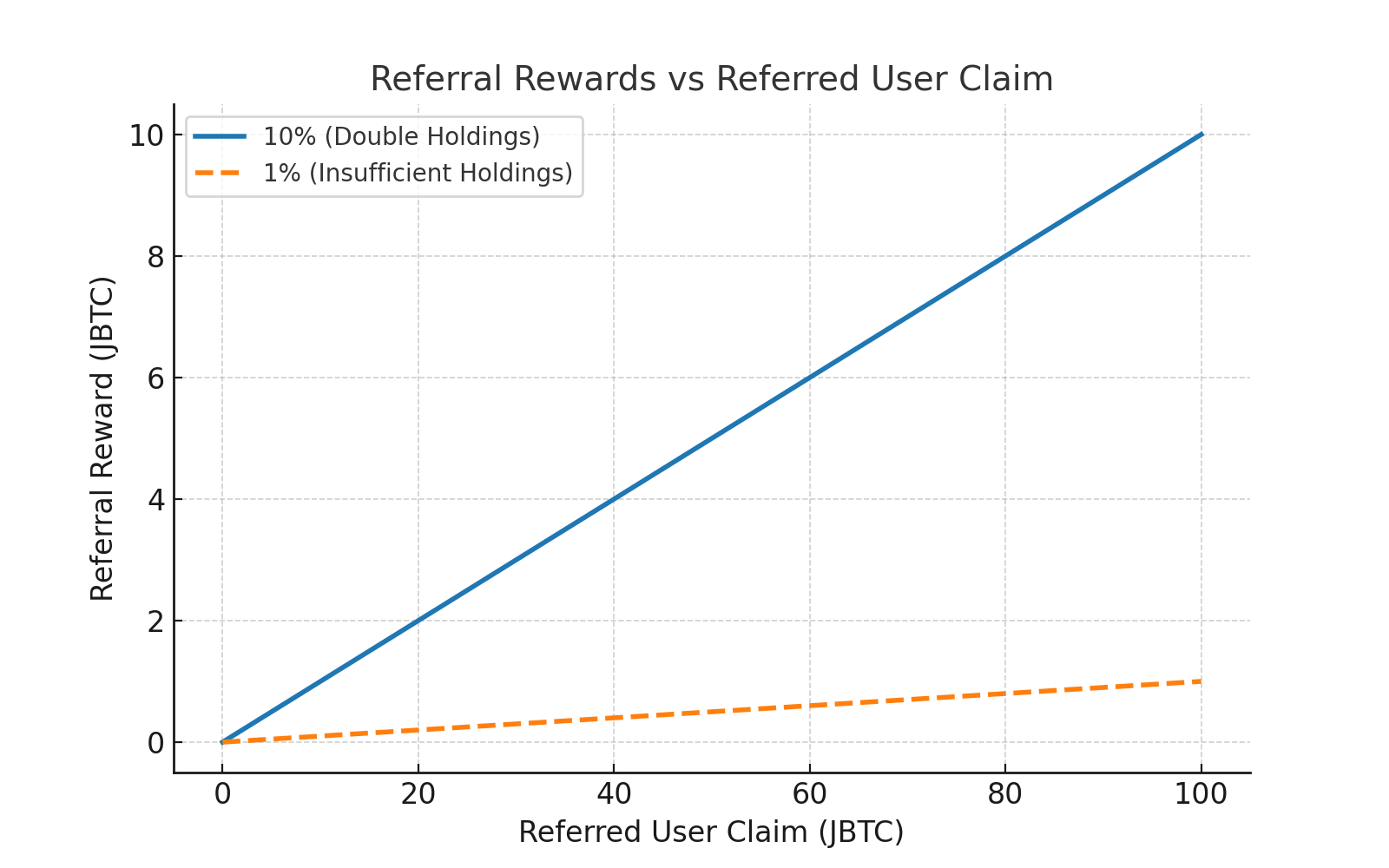

JBTC caps supply at 21,000,000 tokens with 20,000,000 locked in a reward pool and ~1,000,000 circulating at genesis. Daily emissions follow a halving-like multi-year schedule; claims are proportional to holdings with a 0.5% per-day cap. Year-specific system fees apply (1% → 5%). A single-level referral pays 10% or 1% depending on a double-hold rule. All logic is enforced on-chain for determinism and transparency.

1. Introduction

Motivation: remove PoW energy costs and PoS lock-up centralization by distributing rewards purely by ownership (PoH). The PoH model grants rewards to holders in self-custodial wallets, computed and paid by immutable smart contract logic without off-chain intervention.

No mining or validator lock-ups required.

Eligibility and payouts computed on-chain at claim time.

Reward pool: 20,000,000 JBTC; circulating at genesis: 1,000,000 JBTC.

2. System Overview

JBTC is a BEP-20 smart contract system focused on deterministic reward calculations, gas efficiency, and auditability.

Token Module (BEP-20, 18 decimals).

Reward Vault: holds 20,000,000 JBTC, daily allocations released per schedule; unclaimed rewards remain in vault.

Proof-of-Holding Claim Engine: enforces 24h cooldowns and 0.5% cap.

Referral Mechanism: single-level, double-hold rule (10% or 1%).

System Fee Sink: year-specific fees routed to system wallet pre-referral.

Immutable parameters ensure no post-deploy modification of core economics.

3. State Variables & Invariants

Total Supply = 21,000,000 JBTC (fixed).

Circulating Supply = TotalSupply − VaultBalance (updated on claims).

Immutable parameters: emission schedule, claim cap, fee rates, referral rules.

Claim Cooldown: 24 hours per wallet enforced with timestamps.

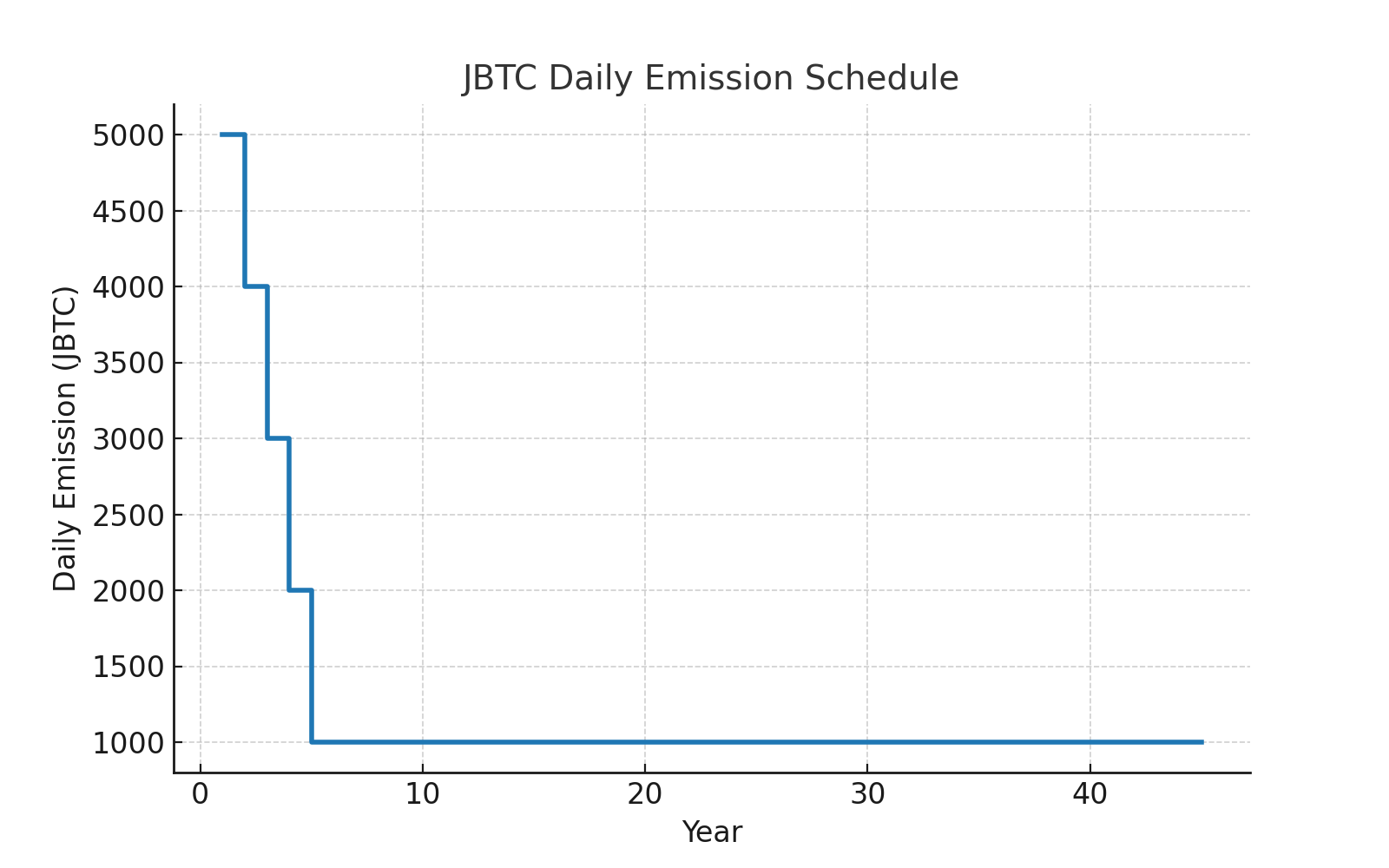

4. Timekeeping & Reward Schedule

Year 1: 5,000 JBTC/day

Year 2: 4,000 JBTC/day

Year 3: 3,000 JBTC/day

Year 4: 2,000 JBTC/day

Year 5+: 1,000 JBTC/day until depletion (~45 years).

Unclaimed daily rewards remain in the vault (no rollover).

5. Off-Chain Interaction Layer

DApp connects wallets via Web3 providers and exposes previewClaim() for a transparent breakdown (gross claim, fee, referral, net) prior to signing the on-chain claim transaction.

Wallet providers: MetaMask, Trust Wallet, etc. (EIP-1193).

previewClaim() returns pre-signature breakdown for UX clarity.

6. Security Features

OpenZeppelin audited libraries for BEP-20 and SafeMath.

Reentrancy guards on claim() flow.

No loops over holders—O(1) calculations where possible for gas efficiency.

Event logging for ClaimExecuted, ReferralPaid, SystemFeeTransferred.

7. Deterministic Claim Execution Order

Eligibility check (balance > 0, cooldown passed).

Pro-rata calculation of daily pool share.

Apply 0.5% max claim cap.

Deduct year-specific system fee, evaluate referral percentage, distribute net and referral, update state and emit events.

8. Performance & Gas Optimization

Constant-time operations; avoid dynamic loops or expensive external calls.

BSC gas optimizations for low-fee execution with full numeric precision.

9. Initial Token Allocation

Allocation balances long-term rewards with immediate liquidity and operational reserves to ensure stability at launch.

Locked Reward Pool: 20,000,000 JBTC (95.24%).

Presale Allocation: 700,000 JBTC (3.33%).

Exchange Liquidity Provision: 250,000 JBTC (1.19%).

Founding Team Reserve: 50,000 JBTC (0.24%) in multi-sig wallet with controls.

Initial Circulating Supply (genesis): 1,000,000 JBTC.

10. Monetary Policy & Supply Schedule

Immutable on-chain emission schedule and fixed supply protect against inflation and enable decades-long predictable reward modeling.

Total Supply: 21,000,000 JBTC (no minting).

Daily emission schedule as in Section 4.

Claim cap: 0.5% per wallet per 24h.

System fee applied per-year before referral calculation (1%→5%).

Circulating supply increases only via claims, reducing per-token rewards over time.

11. Proof-of-Holding Protocol (PoH)

PoH allocates rewards solely based on on-chain holdings in self-custodied wallets; computations performed by the contract at claim time.

Eligibility: balance > 0 and wallet is non-custodial (exchange wallets excluded).

Core formula uses Holding, DailyRewardPool, and CirculatingSupply with 0.5% cap.

On-chain reads prevent manipulation; snapshot is the block timestamp at claim execution.

12. Claim Mechanics

The claim process comprises previewClaim() off-chain preview and claim() on-chain execution performing eligibility, calculation, fee/referral deduction, payout and state updates atomically.

UX Flow: connect wallet → previewClaim() → sign claim() → on-chain execution → UI updates transaction info.

On-chain sequence: verify cooldown & balance, compute gross claim, apply cap, deduct fee, compute referral, transfer funds, update timestamps & circulating supply, emit events.

Failure conditions: claim before cooldown, zero/ ineligible balance, calculated claim = 0, gas estimation failure.

Accessibility: i18n, mobile-optimized UI, WCAG considerations.

13. Referral Logic, Worked Examples & Fee Flow

Single-level referral with a double-hold rule: referrer gets 10% if they hold ≥ 2× combined holdings of referrals in last 24h, otherwise 1%. Referral rewards are paid from daily pool after system fee.

Example (Double-Hold Met): shows gross → fee → referral → net breakdown.

Example (Not Met): shows alternate referral rate and resulting net.

Fee flow sequence: compute gross → deduct system fee to treasury → compute referral from net → transfer referral → transfer net to claimant.

14. Governance & Roadmap

Core economic rules are immutable; a DAO may be introduced for ecosystem-level decisions while preserving immutable reward logic. Roadmap covers genesis, ecosystem growth, DAO activation, and scalability improvements across phases.

Governance: smart-contract-enforced rules; optional token-weighted DAO for non-core decisions.

Roadmap Phases: Genesis & Stability → Ecosystem Growth → DAO Activation → Sustainability & Scalability.

Upgrade policy: immutable core; optional opt-in modules for extensions; forks handled by chain consensus and DAO mediation when relevant.

15. Security Architecture & Audit Framework

Security goals: immutability, transparency, minimized attack surface.

Smart contract safety: reentrancy guards, SafeMath, access controls, parameter validation, timelocks for non-core ops.

Network: TLS 1.3 hosting, WAF, DDoS protection, signed API calls, active monitoring.

Audits: internal multi-phase + external third-party audits; continuous on-chain verification.

Bug bounty: severity-based payouts and public guidelines.

Disaster recovery: multi-sig treasury, redundant nodes, incident protocol.

16. Appendix — Mathematical Models & Constants

Formal constants, claim & referral formulas, and worked examples for reproducibility and verification.

Constants: TotalSupply = 21,000,000; LockedSupplyInitial = 20,000,000; CirculatingInitial = 1,000,000.

DailyRewardYear1 = 5,000; Year2 = 4,000; Year3 = 3,000; Year4 = 2,000; Year5+ = 1,000.

MaxDailyClaimRate = 0.5% (Max half percent of the Lowest Holding).

System Allocation structure: Year 1 = 1%, Year 2 = 2%, Year 3 = 3%, Year 4 = 4%, Year 5 and onwards = 5%.

Claim formula: DailyClaim(user) = minimum of (Lowest Holding × DailyRewardPool / CirculatingSupply) and half percent of the Lowest Holding.

Referral formula: ReferralReward = {10% × Claim if DoubleHold TRUE; else 1% × Claim}.

Supply decay: step-wise emission per year as listed above.

17. Appendix — Glossary of Terms

System fee: year-specific percentage deducted from each claim before referral calculation.

Circulating Supply: portion of tokens publicly available and eligible for claims.

Claim: process of withdrawing daily eligible rewards from the vault.

Daily Reward Pool: fixed daily emission from locked supply.

Double Hold Condition: referrer must hold ≥ 2× combined referrals' holdings (24h) for full referral rate.

MaxDailyClaimRate: 0.5% per wallet per 24h.

PoH: Proof-of-Holding reward mechanism distributing emissions based on holdings.